About e-Cover

The customer-centric e-Cover Online Transaction Portal (“e-Cover”) is offered as

a Software as a Service

(“SaaS”) solution to the insurance industry. This has helped to address the various issues

arising from the biggest

concerns in IT investments, namely the high capital expenditure, difficulties in retaining

IT expertise, the

technology risk, and the high costs of operating and maintaining IT systems. The e-Cover

system is charged on a ‘pay

per use’ basis.

The e-Cover system has all the functionalities to support agencies of any size. It enables

the bigger agencies to

work in a collaborative manner while enabling the smaller ones to have similar

functionalities as the ‘big’ boys.

All the features use the common and familiar interface and the same mode of access. This

enables:

- Quick time-to-market

- Easy and instant implementation

- Ease in learning to use

The e-Cover connectivity to various parties, allow seamless services to be offered to its customers. Furthermore,

e-Cover not only provides end-to-end solutions electronically, creating a paperless environment which helps reduce

the inefficiencies of the current manual processes, it allows insurance policies and confirmations to be printed at

the point of sale.

The e-Cover system was awarded the Asia Pacific ICT Alliance (“APICTA”) Merit Awards for the local and international

“Best of Financial Applications” categories in 2006.

How Does The System Work?

Easy Set Up - The insurance company or Principal would need to carry out

a one-time set-up of the

agents’ codes, and the underwriting and credit rules. Once these have been done, and the

agents have been registered

and provided with their User IDs, the agents can start carrying out their business on-line.

Once logged in, the agents are able to carry out end-to-end transactions for new insurance

policies or for renewal

cases. The agents can view completed transactions as well as policies due for renewal.

The e-Cover system allows the agents to transact all approved classes unless there is a

breach in the set business

guidelines, for example non-payment of premiums, Cash Before Cover violation, breach of

authority limits or credit

terms, etc, or any combination thereof. The e-Cover system can help to immediately prevent

the Principal from

further exposure by the action of errant agents.

The e-Cover system can be easily integrated to any back-end system to allow straight through

processing of policies,

thus eliminating the need for double data entry.

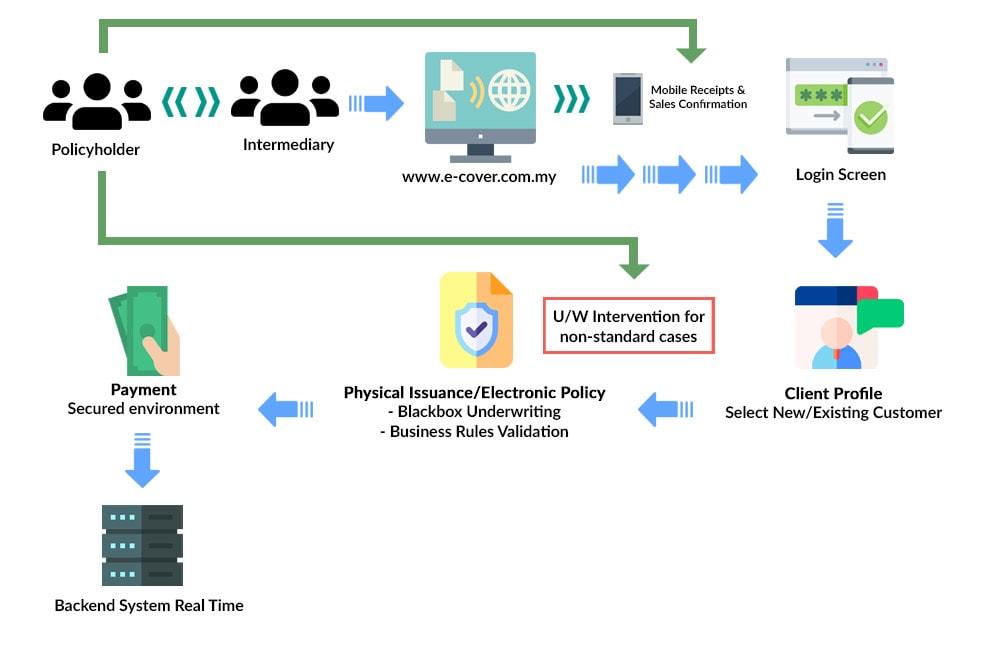

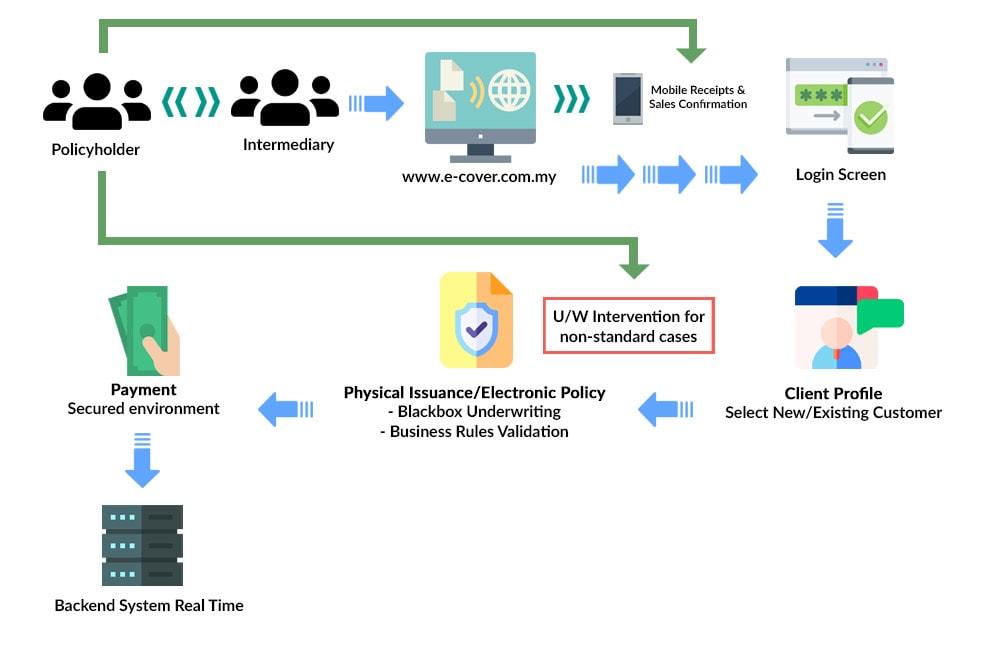

The policyholder will approach the agent who will then log into the e-Cover system using his unique ID and password.

If the policyholder is the agent’s existing customer, the agent can quickly recall the policyholder’s details and

carry out the required transaction. Otherwise, the agent will need to create a new unique Customer Profile using the

Identity Card (IC) number or Company Number for individuals and companies respectively.

The agent will then select the desired class and proceed to issue the policy. As an example, the system has a number

of built-in checks to ensure that back-dating of policies cannot be done. Other checks on outstanding claims and

unpaid premiums can also be incorporated.

The Black Box underwriting capability will ensure that risks falling outside the insurer’s underwriting guide will

not be accepted. The premium will be calculated according to the insurer’s rating table.

The insurer can opt to allow underwriting intervention for non-standard risks. During this exception handling

process, the underwriter can be given an e-mail alert if there is a risk pending his attention. The underwriter can

then log into the e-Cover system to review the rates and terms for acceptance.

Once the risk has been bound, the agent can then proceed to make payment for the premium. On-line payments can be

accepted using credit cards, as the e-Cover system can be connected to the bank’s payment gateway. The system can

also provide a payment confirmation to the policyholder, if required. The e-Cover system can also send mobile

receipts via SMS right to the policyholder’s phone. Mobile receipts are timely and sent to the intended party.

Once payment has been approved, the agent can print a soft copy of the new policy in PDF format and e-mail to the

policyholder – a process that can be completed in minutes.

Upon the completion of the transaction, the e-Cover system will then send the insurance and payment details to the

insurance company’s backend system for posting to the statement of accounts.

The end-to-end processing capability ensures minimum account reconciliation problems.

Key Functionalities

The e-Cover modules were all designed with both the insurance companies and

agents (intermediaries) in

mind. Rexit has been continually adding new functionalities to provide the users of our

portal an added business

edge.

Key Functionalities include:

- Web-Based System

The e-Cover web-based application allows users to carry out transactions 24/7 anywhere.

- Straight Through Processing from Frontend

The data entry for e-Cover applications could be distributed to the attending agents or

intermediary, thus alleviating the need for additional administration and allows

straight through processing. Policies can be automatically processed and printing of

policy certificates can be done at the agent’s location.

- Daily Production Updates via SMS/E-mail

Participating agents and insurers have the option of having daily production updates

sent directly to their smartphones or, tablets for performance tracking.

-

Management of Agent’s Business

The e-Cover application has built-in personal productivity tools such as

calendaring, to do lists, renewal reminders etc for higher sales activity and

productivity.

- Renewal Management

e-Cover’s Renewal Notice module allows the user to view impending renewals by date and

class, in addition to providing soft or hardcopies of the renewal listing on demand.

- Online User Manual

The online user manual provides easy access to information on how to use the e-Cover

system.

- Electronic Bulletin Board

The e-Cover system Bulletin Board provides the Principal with an effective communication

tool for important updates or the latest news.

- e-Policy and Endorsements

Policies and endorsements can be printed in PDF formats for printing into physical

copies or to be delivered to the policyholder via e-mail. A security feature in the form

of an algorithm that generates a unique series of numbers for each document generated

provides the insurer with the means to authenticate documents and eliminate fraud.

- e-Statements for Agents

The e-Cover system is also able to provide electronic statements for agents, enabling real time tracking of

transactions and reducing printing costs.

- e-Payment Facilities

With connectivity to any bank’s payment gateway, the e-Cover application can accept

premium payments using credit cards or other electronic means.

- Exception Alerts

The e-Cover system is able to facilitate e-mail or SMS alerts to the designated

person(s) when a new insurance application is made or a new claim is registered.

- SMS Notifications

The Principal may utilize e-Cover’s SMS notification feature to communicate with its

customers or agents:

- Interactive function – Policy enquiry, commission statements, claims

enquiry, contests and campaigns.

- Broadcast function – Transaction status or confirmation, reminders,

premiums

due, commission paid, endorsement details, birthday greetings and promotion.

- Contact Management

The e-Cover Assist is a web based tele-sales support system which enables insurers and

agents to enhance their customer service offerings. Agents and insurers now have the

ability to call on their clients guided by a contact management system that facilitates

follow-up, renewal and payment processing. This feature allows better contact and

renewal management whilst minimising lapse rates of existing business.

- Company Branding

The e-Cover portal is fully customisable in terms of look and feel in order to present

the insurer’s branding to intermediaries and the general public. The Principal may use

their own URL address and users are allowed single sign-on access.

- Mobile Version

In order to cater to the growth and acceptance of mobile devices, the e-Cover is

currently available for both the Apple iOS and the Google Android operating systems.

Recognising the increasing use of tablets and large screen smartphones, Rexit is

progressively rolling out the mobile version to cater for the various classes, starting

with motor.

- Self-Management by Insurance Companies

Rexit is sensitive to our customers’ requirements and has designed many of the e-Cover

features to be configurable and parameterised. Principals which opt for self-management

of certain e-Cover functions, in order to respond to market needs more quickly, are

allowed to do so.

- Portal Features

The e-Cover has been designed to allow access by multiple user types including the

policyholders for self-service. The e-Cover can incorporate policyholders’ access in

order for them check their policy details, payment and claims records, and to carry out

policy renewals and premium payments.

Other features like online claims notifications can be included depending on the

insurance companies’ requirements.

- Download Centre

e-Cover can also allow insurers to upload various forms and documents for access by

their agents as well as policyholders. Examples of such forms may include standard

policy wordings and claims forms.

- Secure Transmission of Data

The e-Cover system is securely accessed through HTTPS (certificate from Verisign with

RSA 1024 bit) which conforms to BNM GPIS 1 security requirements. In addition to

firewalls, our communication infrastructure is also protected by the ISS Proventia

Intrusion Prevention System.

- Stable and Tested Infrastructure

The e-Cover Life system is built on the proven e-Cover architecture that averages over

600,000 transactions monthly involving all classes of insurance, which to date is worth

over RM1.6 billion annually.

Effective Control Measures

The following are control features which are available with the e-Cover Online

Insurance portal:

- Access/ Log-in Control

The e-Cover system enables the principle to determine the screens accessible to its

users. User login can be controlled by preset log-in times for staff of an agency or

other users. The system also allows the Principal to deactivate accounts that are

inactive/black listed and determine what cover notes and the quantity an agent can

issue.

- Management of Intermediaries

e-Cover allows the Principal to control its intermediaries by configuring restrictions

such as credit limits, sum insured, type of insurance class, payment patterns and other

parameters.

- Black Box Underwriting

With e-Cover, the Principal can pre-determine simple underwriting rules to automatically

decline or refer certain types of risks for faster processing of insurance applications.

e-Cover provides flexibility whereby underwriting rules can be applied not only on a

global basis but also to agents based on a geographical location or by group/type.

-

Underwriting Intervention

e-Cover’s Principal administration module allows the underwriters to manually

intervene and provide input for more complex cases to determine whether it is a risk

that the Principal should undertake.

- Cover Note Submission Control

e-Cover enables the Principal to confirm and review each submission of cover note for

control purposes.

- Payment Information

The Principal can control the methods of payment the intermediaries are allowed to use,

namely: Cash, cheque, credit card, cash/debit cards and e-payment. Additionally, each

transaction detail can be tracked and matched to the actual payment received for

reconciliation.

- Offline Payment/Collection Tracking

Offline payments made by agents using cash, cheque or credit card can also be tracked

and reconciled as the e-Cover system allow details of these payments to be recorded

online.

- Cash Before Cover (CBC) Control

The system allows the Principal to monitor premium payments received for motor

insurance. Agents that fail to make payments within the stipulated time will be barred

from performing further transactions through e-Cover. The Principal is able to set the

CBC rules by calendar or working days.

- Receipting

Agents will be able to print receipts for the premiums received from policyholders using

the receipting functionality. This is a value added feature that makes it convenient for

the agents to issue auto-generated receipts instead of manually written ones.

- Security Digit Checksum

e-Cover’s internal security algorithm generates a unique series of number based on the

transaction details and this will be printed on the insurance certificate. At any time,

the Principal or policyholder will be able to verify the authenticity of any policies

issued.

Product Modules of e-Cover

The Motor and Non-Motor Classes of Insurance available, are:-

- Motor

- Driver and Passengers Personal Accident

- Personal Accident (Group & Individual)

- Foreign Workers Medical / Health (Group & Individual)

- Foreign Workers Insurance Guarantee

- Foreign Workers Compensation Scheme

- Fire

- Houseowner / Householder

- Marine Cargo

- Marine Goods in Transit

- Marine Open Cover

- Liability

- Golfer's Insurance

- Maid Insurance

- General Cover Note (Free Text)

The e-Cover system is able to cater for the tariff market as well as the more complex de-tariff markets, as the system has been implemented in Singapore and Thailand.

Benefits of e-Cover

The e-Cover system has provided obvious benefits to the various key stakeholders and this has been reflected by the

continuous adoption of new and enhanced services which are being introduced.

To Insurance Companies

- Enhanced management and control of agencies

- Rapid implementation period

- Maintenance free

- Electronic payment settlement

- Immediate dissemination of information to agents

To Policyholders

- Peace of mind – Fraud-free insurance

- Better service from agents

- Immediate receipt of policy

- Easy accessibility

To Intermediaries

- Ease of use – Common look & feel

- Time saving – online for all transactions

- Greater mobility for agents

- Improved customer service

To the Government

- Improved perception of the financial industry

- Better accessibility leading to improved enforcement

- Access to readily available information